Suriname election soothes investor nerves

Calmer political waters should help turn the country into a global exploration hotspot.

by Charles Waine

The small Latin American nation of Suriname is poised for profound change. Revenues from major offshore oil discoveries announced this year could transform the country’s long-term economic prospects. And, following the resolution of an election deadlock, a new coalition government has finally wrenched power from strongman president Desi Bouterse after a decade at the helm.

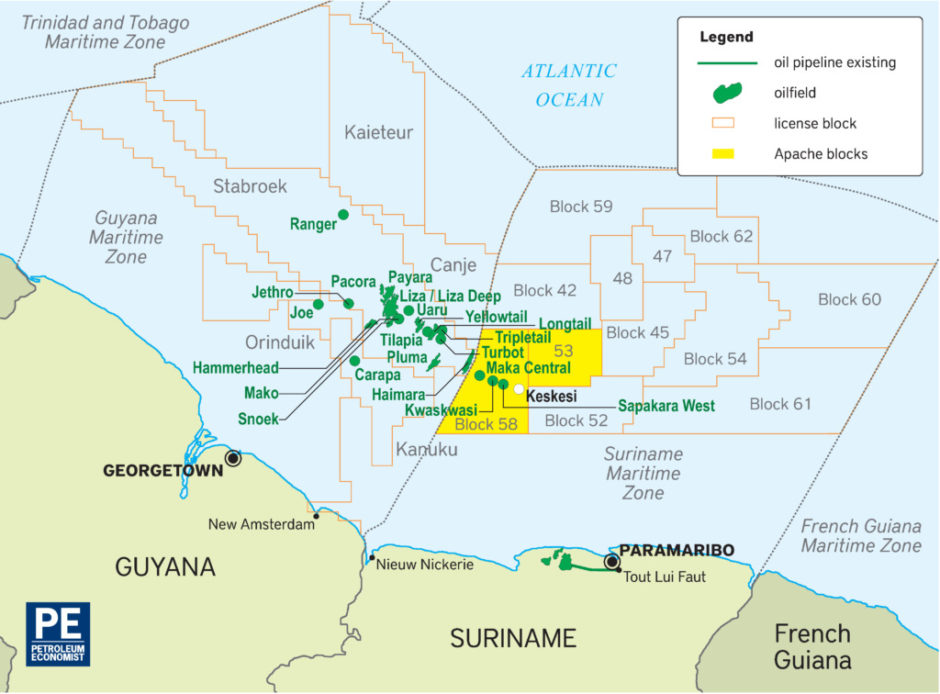

The relative political stability is good news for investors and progress on existing oil ventures. In July, US independent operator Apache made its third oil find of the year in block 58. Incoming president Chandrikapersad Santokhi has promised to honour existing contracts and remains supportive of the oil sector.

“We expect Santokhi to continue with planned regulatory improvements, promoting investment and exploration, potentially bidding rounds for the remaining offshore acreage, and maintain frontier terms for royalties,” says Christian Wagner, Americas analyst at political risk consultancy Verisk Maplecroft.

Economic gloom

But the immediate concern is a deep economic crisis and growing threat of social unrest. Suriname stands on the brink of default, with the World Bank expecting GDP to contract by at least 5pc this year. Covid-19 infections have also started to climb, raising fears of a looming health emergency. “Suriname is one of the worst affected in the Caribbean,” says Marten Schalkwijk, adviser to Santokhi.“The oil discoveries are a positive development, but we should not put all our eggs in one basket” Schalkwijk

The government is equally concerned that the oil revenue windfall may never transform the country. “Given the current economic situation, the Surinamese government runs the risk of being the weakest party and benefitting less from forthcoming oil deals than seems appropriate,” says Peter Meel, an expert on Suriname political history at Leiden University in the Netherlands. “In that case, the growth of this sector will be wishful thinking rather than commonsense policy.”

Oil price volatility in 2020 has demonstrated the need for many major producing nations to diversify their economies, and Suriname is wary of the future danger. “For 50 or 60 years, we have been dependent on mineral wealth,” says Schalkwijk. “We do not want to relapse. The oil discoveries are a positive development, but we should not put all our eggs in one basket.”

Clean-up job

Other major challenges include the country’s longstanding reputation for drug smuggling, corruption and money laundering. In 2018, a corruption study from German NGO Transparency International listed the South American nation 73rd of the 180 countries profiled, with the lowest-ranking countries being assessed as the most corrupt. Over the same period, the World Bank ranked Suriname’s perceived corruption in the 48th percentile from over 200 countries, a similar level to oil-rich neighbour Guyana.

Since his inauguration, Santokhi has pledged to fight corruption and deploy all legal means to prosecute perpetrators. “There have been a number of much talked about corruption scandals, and particularly in the past year the Central Bank of Suriname and the ministry of finance have been involved in irresponsible and outright damaging acts that have ruined the country’s economy,” says Meel.

Next steps

And while much remains to be done in preparation, further offshore exploration is on the way. Malaysian NOC Petronas plans to drill the Sloanea prospect in block 52 during the third quarter. In May, ExxonMobil joined the partnership developing the block after Petronas farmed down a 50pc stake.5pc – GDP contraction forecast by the World Bank

Following three successful wildcats, Apache will drill its fourth and final well of the year at the Keskesi prospect in block 58 in October. The operator has struggled to offset plunging oil prices in the first half of the year, cutting planned upstream investment by $650mn and posting a $332mn loss.

Swiss investment bank Credit Suisse forecasts that Apache will suffer significant production declines into 2021. The company’s output fell by just 1.7pc year-on-year across the first half of the year, but Credit Suisse estimates capex cuts could cause it to fall by 9pc into 2021, increasing reliance on future Surinamese oil.

Into next year, Anglo-Irish independent Tullow plans to drill its Goliath Voltzberg-North prospect in block 47 during the first quarter. US independent Hess is scheduled to spud a well in block 59, while fellow US indie Kosmos Energy is expected to do the same in block 42. “With the three hits this year, and gradual recovery from the oil price collapse, I expect UK explorer Cairn (block 61) and Tullow (block 62) to resume drilling plans in 2021,” adds Wagner.

[Overgenomen uit Petroleum Economist, 11 August 2020]